Top Investment Insights for Today’s Market

Are you curious about how to navigate todays unpredictable investment landscape? With markets changing faster than ever, knowing where to invest can feel overwhelming. This article will break down the top investment insights to help you make informed decisions.

What Should You Know About Today’s Market?

Today’s market is marked by volatility and uncertainty. Recent shifts in the economy, interest rates, and global events have all played a role in shaping investment trends. Understanding these factors can help you make better choices.

According to a recent report by Investopedia, 69% of investors are feeling anxious about the market. You are not alone if you share this concern!

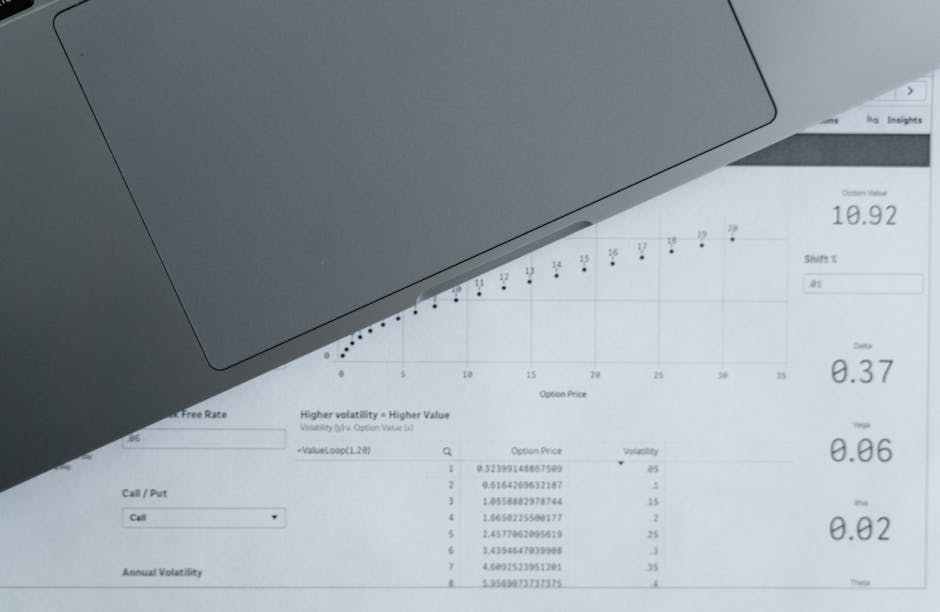

How Are Interest Rates Affecting Investments?

Interest rates are a crucial factor in the investment equation. When rates go up, borrowing money becomes more expensive. This can lead to reduced consumer spending and lower corporate profits.

For example, think about your mortgage or car loan. If interest rates rise, your monthly payments increase, making it harder to afford those big purchases. Similarly, companies face higher costs and may cut back on growth plans, affecting their stock prices.

- Higher interest rates can lead to lower stock prices.

- Bonds may become more attractive than stocks due to better yields.

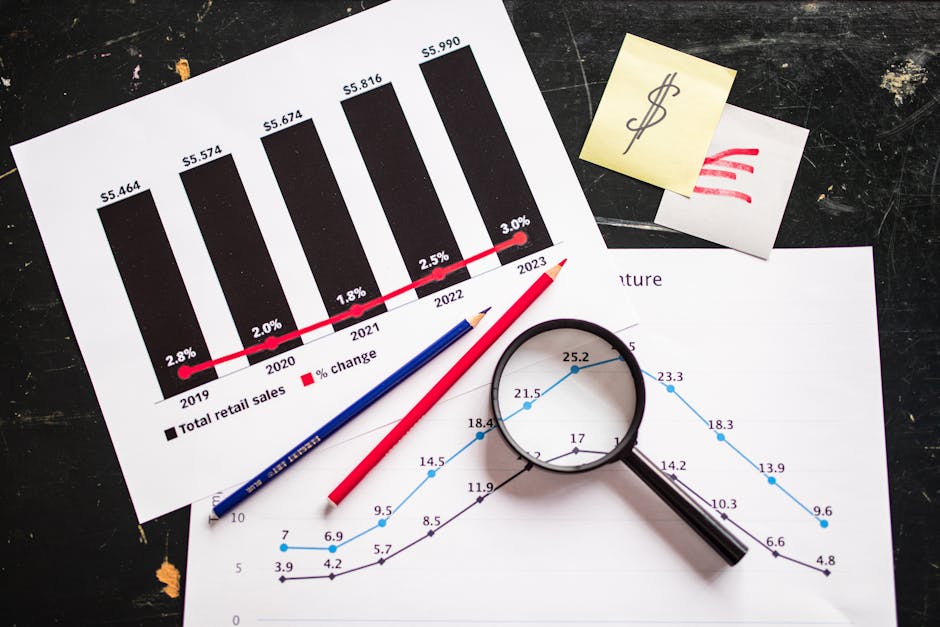

What Are the Current Trends in Stocks?

Stock markets can be tricky. Recently, tech stocks have led the market due to strong demand and innovation. Companies like Apple and Microsoft continue to thrive, but it’s essential to watch out for market corrections.

On the flip side, sectors like energy and travel are bouncing back. As restrictions ease, these industries are gaining traction. This shows that diversifying your portfolio can be a smart strategy.

Why Is Diversification Important?

Diversification means spreading your investments across different asset classes. This practice reduces risk and can lead to better long-term returns. Think of it like not putting all your eggs in one basket.

- Mix stocks and bonds to balance risk.

- Consider real estate or commodities for variety.

For instance, if you invest only in tech stocks and the market dips, you could suffer significant losses. However, if you also own bonds or real estate, those assets may stabilize your portfolio.

What About Cryptocurrency?

Cryptocurrency has become a hot topic lately. Many investors are curious about Bitcoin, Ethereum, and others. While they can offer high returns, they also come with high risks.

The price of Bitcoin can change dramatically in just a few hours. For every success story, there are also cautionary tales of losses. If you’re considering investing in crypto, start small and be prepared for volatility.

Is Now a Good Time to Invest?

Many people wonder if now is the right time to jump into the market. The answer depends on your financial goals and risk tolerance.

Experts often suggest looking for opportunities during market dips. Buying low can lead to profits when the market rebounds. However, ensure you do your research and don’t rush into decisions.

What Should You Know About ESG Investing?

Environmental, Social, and Governance (ESG) investing is on the rise. This approach means investing in companies that prioritize sustainability and ethical practices. Many investors are drawn to this style because it aligns their investments with their values.

Companies focusing on ESG practices often show strong long-term growth. For example, firms that reduce waste and promote equality tend to attract loyal customers.

How Can You Stay Informed?

Staying updated with market news is crucial for making smart investments. Follow reliable financial news sources and consider subscribing to investment newsletters. Knowledge is power in the world of investing!

What Should You Do Next?

As you consider your investment strategy, remember these key takeaways:

- Monitor interest rates and their impact on your investments.

- Diversify your portfolio across different asset classes.

- Be cautious with high-risk investments like cryptocurrency.

- Explore ESG options that align with your values.

- Stay informed by following credible financial news.

Conclusion: Take Action Wisely

The investment landscape is constantly changing. By keeping these insights in mind, you can navigate today’s market with confidence. Remember, investing is a marathon, not a sprint. Stay patient, stay informed, and let your money work for you.

Are you ready to take the next step? Start by reviewing your current investments and consider how these insights might apply to your situation.

For more tips on effective investing strategies, check out our article on diversification strategies.